Why Choose American Tax Support ?

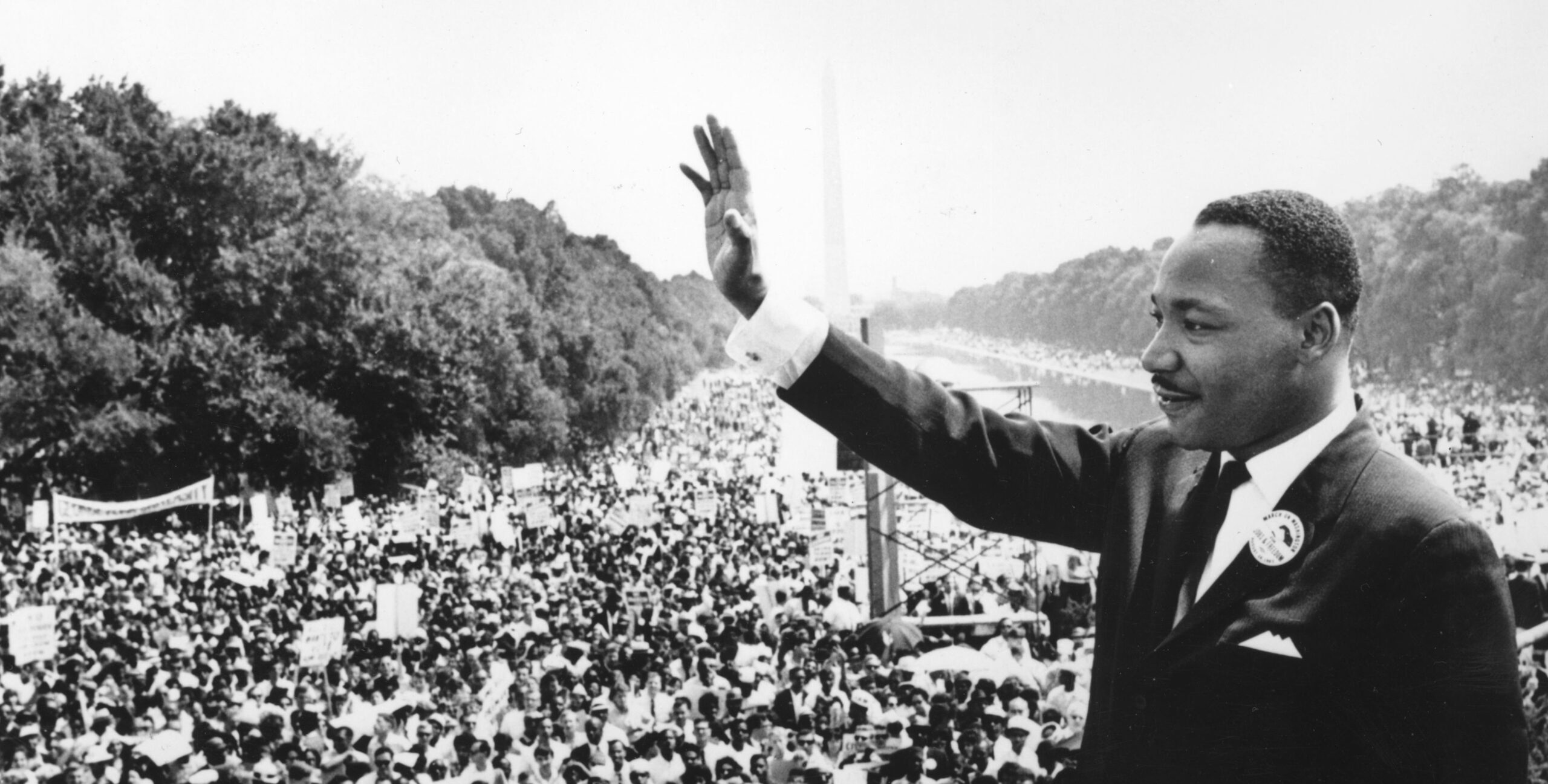

Our foundation at American Tax Support is based on FOUR major principles. These principles are efficiency, convenience, certainty, and fairness. Certainty implies that the taxing authority needs to clarify the reason and method of paying the tax. Convenience deals with the ease of remitting taxes. Fairness means that the taxes align with taxpayers’ ability to pay based on their needs. The IRS is a COLLECTION AGENCY. AMERICAN TAX SUPPORT is a PROTECTION AGENCY. The IRS collected a single-year record of $4.9 trillion of total tax revenue from return filings in fiscal year 2022 . The US primarily generates revenues from taxes. Americans contributed an average of $15,098 per person to federal revenues in 2022. This is nearly DOUBLE what Americans paid 40 years ago after adjusting for inflation. You have RIGHTS. USE THEM. WE CAN HELP.

Tax Debt Settlement

Tax Assistance

Business Support

ARE YOU ELIGIBLE FOR TAX REDUCTION?

As low tax debt as possible for our clients is ALWAYS our goal. We acknowledge that facing financial difficulties can be quite stressful, and it can be extremely unsettling to have the IRS or State hovering over you. ARE YOU OVERPAYING TAXES?

Three Simple Steps for Tax Relief

STEP 1: CONSULTATION

Free Evaluation

Qualification

Advice

Explore Directions

STEP 2: INVESTIGATION

Adhere Protections

Explore Options

Analyze your choices for case resolution

STEP 3: RESOLUTION

Ensure IRS/STATE Compliance

Reach the optimal resolution

Close case

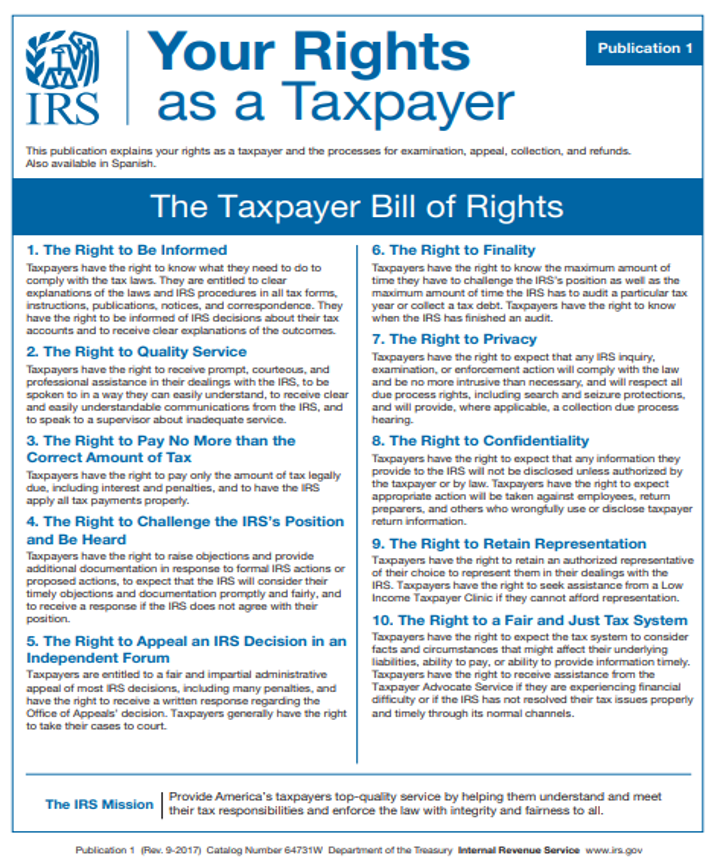

The Taxpayer Bill of Rights is a set of rights that outlines the fundamental protections afforded to taxpayers by the Internal Revenue Service (IRS) in the United States. These rights are intended to ensure that taxpayers are treated fairly and have access to certain safeguards in their dealings with the IRS.